A single integration to over 100+ Datasets

with built in risk analysis and fraud intelligence

Modular Services

A suite of API Products with low code integration options designed to empower and secure business processes.

KYB / KYC

Verify your clients' identity digitally, including Biometric facial and finger print verifications with liveliness checks to meet regulatory requirements.

Bank Account

Verification

Real-time verifications on bank accounts owership and transactions status.

AML / PEP Checks

Check individuals with potential high risk of political exposure, involvement in corruption and money laundering.

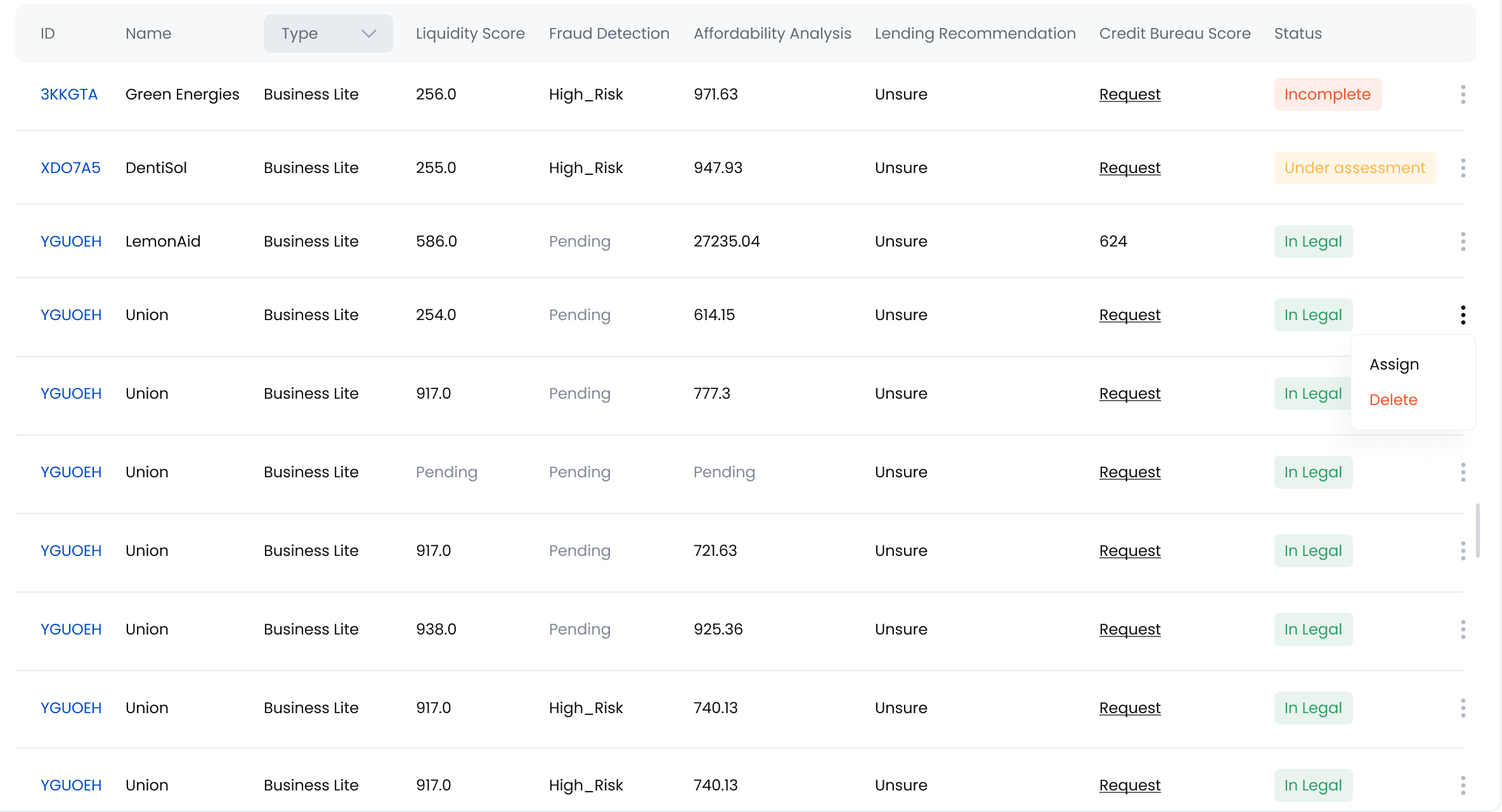

Risk Scoring

Use our alternative scoring to run affordability, liquidity and risk assessments. Receive credit checks through Transunion, Experian and VerifyID.

Financial

Insights

Enhance decisions with financial analysis, fraud alerts and health forecasts.

Open Banking

Extract real-time transaction history from customer bank account feeds from local SA banks.